Read the report (pdf)

México’s energy reform offers the prospect of enormous wealth generation over the next 5 years. The opening of the oil and gas sector, along with the transformation of the power industry, will both drive hydrocarbons production and propel Mexican competitiveness. Enormous expectations have been created by the reform, encouraged heavily by both the Mexican government and international investors.

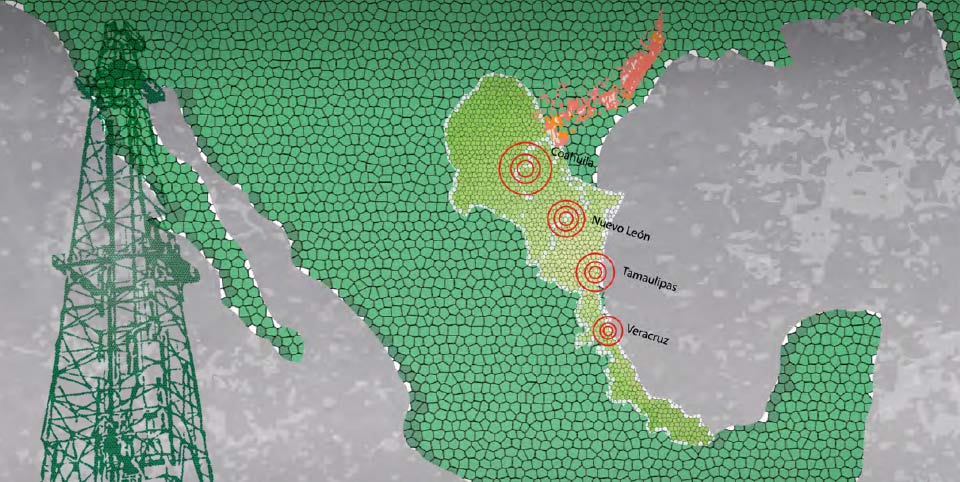

The shale prospects of Mexico are an integral part of this equation, and the Sabinas, Burgos, Tampico-Misantla and Veracruz shale basins hold impressive potential. The development of these onshore resources implies significant investments in infrastructure, tax revenue for local authorities, job creation and the possibility of profit sharing through land access agreements. The experience of the last decade in Texas and other parts of the United States supports this argument. As multiple studies – including the impressive UTSA 2014 report – have shown, the direct and indirect economic impact of the shale industry is indeed enormous and transformative. The harnessing of hydrocarbons wealth in the subsoil, combined with the development of the services sector and major infrastructure projects, will mean the creation of more than 196,000 jobs per year and the generation of more than $137 billion for the state of Texas by 2023. In 2013 alone, shale plays supported 155,000 jobs and generated around $4.4 billion in tax revenue for the state.

However, the conjunction of diverse factors, including the global price environment, the complications of the contract terms offered by the Mexican government, social license issues and infrastructure limitations all complicate the panorama for shale development. A number of analysts have recently noted that expectations for the development of the country ́ s shale reserves should be moderated and that the time horizon for the development of the sector should be extended to between 5-10 years.

This is not to say that the benefits of shale development in Mexico will not be realized. On the contrary, what the experience of the past twelve months has shown us is that a more complicated business environment serves to drive innovation. The new technologies, particularly those which lower costs and assist in hitting the “sweet spot” of shale plays, have meant that, shale plays that were unprofitable under $100/barrel have become profitable even in a period of lower oil prices. Rather than a temporal factor such as the international oil price, shale development in Mexico will depend upon the successful navigation of Mexico´s national and local environment, and this study provides a road map for understanding both the energy reform process and the conditions in the states that hold shale reserves. By shedding light on these conditions, it is hoped that business and governments will be able to maximize the potential from shale, working together with local communities to generate the prosperity and employment that are now within reach.

Duncan Wood,

Director of the Mexico Institute of the Woodrow Wilson International Center for Scholars

Leave a Reply